Can’t we make buying into a home as easy as ordering a curry? Wouldn’t that help solve the Housing Crisis? How do we help solve the current supply shortage, and rescue the hundreds of thousands of willing buyers who are stuck in a rental situation.

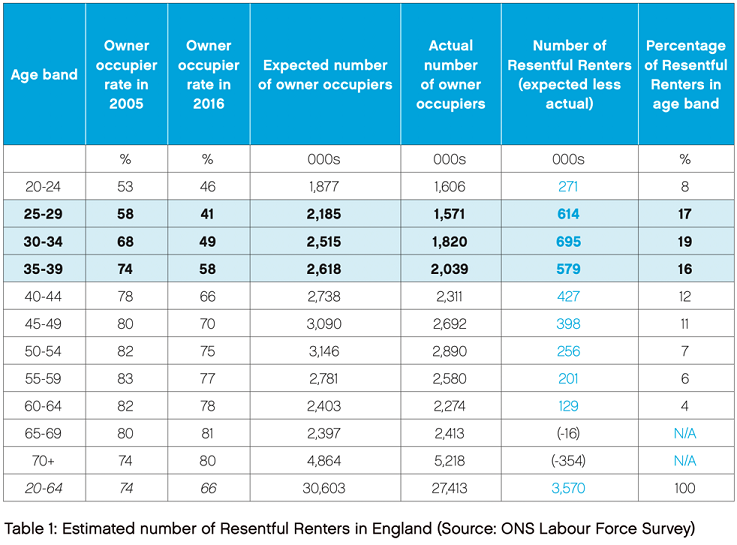

Did you know there are, according to the excellent Resentful Renters Report for the Centre for Policy Studies, 3.57 million people who could have (had that financial collapse not happened over a decade ago) bought their homes but now cannot? Their income just doesn’t stack up, yet they are paying rent each month probably more than the monthly mortgage would be.

Did you know that 1.67 million homes have been built since 2008, but there has been an enormous drop in ownership - 2 million homes being acquired by buy to let landlords? Are we turning into Germany, where renting is the norm? Something needs to be done. Especially if, as conservatives, we are to woo back the young and the female. Most dream of owning their own home, but the council house sell-off was a one-off, so we need to get creative.

These statistics are frightening and surely Mrs T would be turning in her grave?

So the stats speak for themselves and we all welcome any initiative to help homebuyers but in my view even the latest deposit guarantee solution is like rearranging the deckchairs on the Titanic - especially if house prices fall and people are risking negative equity. Despite deposit support, many renters cannot save for even a 5% deposit (especially while paying rents at the same time) plus of course the up-front costs of buying which seem to be escalating in both money and complexity. The processes involved in both buying and selling a house are archaic to the extreme and highly stressful for the residents and above all excruciatingly inefficient. If the average deposit in 2017 was £30,000 and the average savings were £3000, I fail to see how the situation will be improved significantly with the new help to buy offer in the budget - banks are guaranteed whilst homeowners are not: the taxpayer holds the risk of people defaulting on their mortgages. Finally, anything that helps buyers get on the market is only half the story since the most important effect is increasing demand whilst not addressing supply.

So what can we do?

We need to rethink it all, and in the process, embrace the potential of new technology, fast track policy and regulatory processes and look at housing in a completely new way. Removing the “paper pain” I call it. This is key. We have seen how Uber makes it easy in cities across the world to order a taxi, Netflix gives us viewing on demand and all of us have witnessed how the high street has been decimated by Amazon and other online retailers.

The latest technology has been seen to tackle big issues in society – so why should the housing crisis be different.

For a start off, it can be attacked by introducing efficiency in ways not seen before: It should be possible to transact property in minutes not months. HM Land Registry demonstrated this in a test a couple of years ago. So I see a future (soon) where people could decide that this is the day they want to own their home in the morning, and actually become owners by the time their celebration curry is delivered at tea time. Such technology has huge benefits both to residents, house sales and even to HMRC if it was connected to the transactions. This technology is possible now, it’s just how to apply it and where the demand comes from to adapt and develop it. We all want the house-buying process to be easier – especially at the moment when demand is so high, due to the stamp duty holiday: searches which usually take weeks, are taking months. A valuation appointment similarly. Solicitors rushed off their feet. It all needs to be redesigned.

So let’s consider identifying what has to be done to break down the barriers to innovation (especially speeding up policy and regulation.)

If it could be done fast for the Covid-19 Vaccine development why not the Housing Crisis? For poor homes cost lives.

But it requires lateral thinking and an agile attitude to change. I’ve had an idea.

Demand is huge in the South West as we are becoming the place to move to, in post-covid Britain; and many of us will have our own examples. On the whole, viable properties are being snapped up at the expense of locals. My niece in Plymouth recently went to view a flat which had had 32 viewings booked on the day it went on the market. My friend in Cornwall looked at a house put on the market via Facebook, (believe it or not) and had to take it down after over 300 enquiries. The new helping hand with deposits, from the budget, is great, but is definitely fueling demand further, when it’s help with supply that we need.

So let’s look at the supply side. After all, with demand ever higher due to lack of new housing, it’s just allowing buy to let landlords increase prices further, should they see fit. And some do. Resulting in even more resentment amongst renters.

A few big builders dominate the new homes market and have their own high prices to pay - new homes always go at a premium. But the bread and butter of house building industry in days gone by, the medium sized builder, sometimes struggles to put a package together nowadays due in large part to uncertainty, so perhaps there’s a channel here to provide a more certain path to selling, once the properties are built. THAT could help boost supply. (Along with a better, faster planning process, sure, and that is apparently being looked into.) Enter the larger institutions who typically would look at buying property as part of their investment portfolio – pension funds etc. ‘Safe’ investments that yield more than the paltry returns they may be getting from interest rates at the moment, are obviously of great interest. But their funding is limited and once it’s gone, it’s gone, and their capital is then tied up into that asset for years and years. Well what if there could be a way to bring them all together?

Perhaps a new rent-to-buy scheme, which sidesteps traditional shared ownership and the legal hoops and restrictions that entails. Like a ‘one’ account, (which is a current account where your excess funds go to reduce your mortgage each month,) a similar set up for rent-to-buy could work, incorporating an understanding between the investor/owner that part of the rent would go each month towards building up incremental ownership. With an app-based control over how much extra you also add each month, maybe this could fill the huge gap in the market, allowing tenants to finally have a huge light at the end of a tunnel and a sense of belonging and peace of mind, knowing they have an interest registered on their home. It would incorporate a big bonus for the investor/owner. The renter gets a home which they see as their own – but they look after it in a way they may not ordinarily do with a rented home – and that’s another bonus for the institution buying a development of a hundred of these homes. And whilst shared ownership works for some, as is highlighted by several TV documentaries, there are snags for others.

What’s more, it could offer owner-institutions the huge benefit of a method of gradually getting back some of their initial layout on capital (the incremental overpayments from the tenant-owners,) whilst obtaining a great deal from the builder at the outset via bulk buy. The builder has the usual bonus of reducing his capital commitment by having a definite buyer, ‘building to order’, if you will.

Then, add the opportunity for bespoke and very appealing green policies to be incorporated into the housing spec, which pleases everybody at all levels, including local planning and national plan, and everyone wins. It means a heat pump from underground heating might more easily replace the gas boilers which an ordinary builder would use, or using built in solar panels and more, which, although an expensive initial outlay to a builder watching his bottom line, would reduce running costs of the home, making it more saleable.

If your landlord acted like that maiden aunt who let you live in her house, but returned a good proportion of the rent at the end and let it become your deposit when it’s time to buy using a traditional mortgage? Only then does the house-buying process occur. The renter, having lived in their home and looked after it for years, reaches the dizzy heights of being able to show the bank that they now own a big proportion of the home, large enough to get a really good loan-to-value and a better mortgage with a lower interest rate, as a result. It would help to streamline the process for banks offering a mortgage further, as it’s clear to see the tenant has already been paying the rent - which could be higher than the resulting mortgage…

Suddenly the resentful renter becomes a happy home owner. Yes, I’ve been thinking long and hard about this.

With 21st century apps being developed, it really could become reality in a few years’ time, that you prove it all from your smartphone, get approval from the bank that day, and the streamlined process means you can click a few more buttons and own it by tea time. Houses can be smarter too and more energy efficient; saving occupiers money and helping saving the planet. No need for keys, an energy system that manages itself and knows when to and when not to heat to suit resident needs. I’m not into automatic fridge re-ordering but I do think there are serious opportunities here to connect smart homes, with smarter (better informed) residents, to smart councils and smart cities; where efficiency is the driving force to hit the Net Zero carbon targets by 2050 if not before and where we all benefit.

We can but dream.

Richard George is CEO of Health Life Prosperity Shared Ltd

hlps.me